Amidst the loud hum of computers, digital gold is born. Churning and churning, hundreds of computers mine for a new form of currency – one that professes to be the decentralized, deflationary disruptor of the modern banking system. It goes by many names – Dogecoin, VibuCoin, Ethereum, and Bitcoin – but they can all be called cryptocurrencies.

Our Changing Climate series

This post is part of a new series created by ethical.net in partnership with Our Changing Climate, an environmental YouTube channel that explores the intersections of social, political, climatic, and food-based issues. Get early access and support this important research by becoming a Patreon.

This is the story of the new digital gold. How it works, its consequences, and what a crypto future looks like. 👇

What is cryptocurrency?

In the digital age, money is taking a new form. If you’re like me, you’ve probably heard people talk about Bitcoin mining or the volatility of Crypto or Tesla’s recent $1.5 billion Bitcoin investment, and just nodded your head obligingly, without a clue as to what any of that really means.

Here’s a quick overview.

In very simple terms, cryptocurrencies, like Bitcoin or Ethereum, are decentralized monetary systems. They rely on cryptography for security and validity, and the acquisition of this digital currency involves hundreds of specialized computers run by ‘miners’ to solve math problems in what’s called a ‘proof-of-work’ model. There are other models, like proof-of-stake, too, but we’ll get into that later.

For now, all you need to know is that cryptocurrencies are valuable, much like real gold, because they’re finite and cracking math problems requires a lot of energy and time. And it’s here, in the physical space where crypto is created, that these digital currencies run into problems.

The problem with cryptocurrency

Drive three hours north of Sydney, Australia and you’ll run into a coal-fired power plant. One that, up until recently, was shut down, but now is churning out electricity for a single company: a Bitcoin operation. That’s right, the Bitcoin mining subsidiary of Australian tech company IOT penned a deal to gain exclusive access to the coal plant, to satiate the energy appetite of its mining operations.

👉 This deal was born out of the simple reality of cryptocurrency mining: the cheaper the energy, the more money you make. That’s because cryptocurrencies require a massive amount of energy.

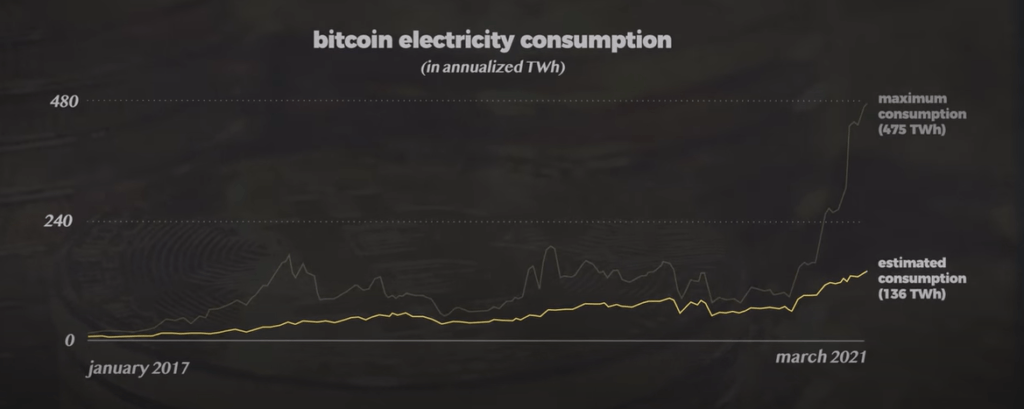

Cambridge University’s Bitcoin Electricity Consumption Index estimates that global Bitcoin mining operations consume an average 136.33 TWh (terawatt-hours) of electricity every single year, while another Bitcoin energy consumption tracker estimates that the consumption level is a bit lower, at around 87 TWh per year.

To put that in perspective, you could power the whole of Sweden for a year with that kind of electricity consumption. And that’s just for Bitcoin; hundreds of other cryptocurrencies also require large amounts of power. 👀

The concerning aspect of this massive energy consumption is that only an estimated 39% of it runs on renewable energy, which includes hydropower. As a result, if Bitcoin electricity consumption rises to 184 TWh per year, which a recent paper from Alex de Vries suggests it will, the carbon footprint of mining could be as much as 90.2 million metric tons, which is about the same yearly emissions footprint as Belgium or Chile. And that’s just for Bitcoin.

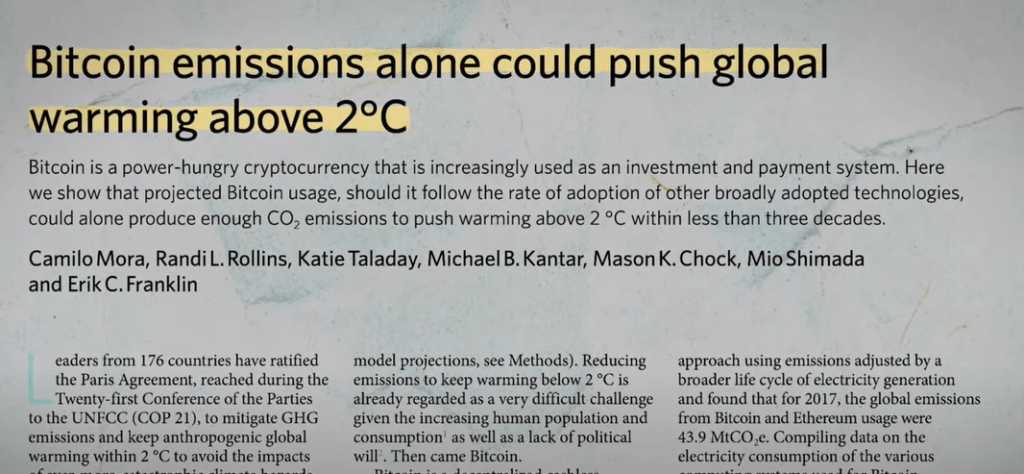

According to Christian Stoll et al, under-studied cryptocurrencies add another 50% on top of Bitcoin’s energy consumption – while another study goes so far as to say that Bitcoin emissions alone could push global warming above 2°C.

📌 But here’s the thing: because Bitcoin and other cryptocurrency mining operations are scattered throughout the world, it’s hard to get solid numbers on energy usage. While these estimates are definitely accurate, it’s hard to know for certain the real scale and energy-intensity of cryptocurrencies, especially as Bitcoin prices skyrocket and new mining operations continue to come online. Regardless, we are adding energy consumption demands equivalent to whole countries in a time when we need to be doing the exact opposite.

The promise of cryptocurrency

Despite these numbers, there seems to be a level of optimism in the Bitcoin and cryptocurrency community. Indeed, as I mentioned before, Tesla recently invested $1.5 billion into Bitcoin. In regards to energy usage, crypto proponents argue that precisely because mining operations require so much energy, they are incentivized to find the cheapest source, which means that as renewables continue to plummet in price, crypto miners will naturally gravitate towards them. While this does seem to make sense in theory, and indeed is happening right now with some miners, an energy researcher at the Technical University in Munich, Christian Stoll, puts it bluntly: “Coal is fueling Bitcoin.”

At the moment, roughly 65% of bitcoin mining happens in China, and most of that is run on coal. Despite this, crypto enthusiasts point to the industry’s tendency to seek out ‘wasted’ energy.

And once again, while this does seem like a great, quasi-sustainable solution, it’s not. Capturing and using flared gas only prolongs the existence of the oil and gas industry by monetizing their waste products. Essentially, natural gas operations can make even more money than they have before, which fossil fuel operations are loving. An article from Oilman Magazine delineates step-by-step why Bitcoin is great for the longevity of natural gas operations.

Finally, cryptocurrency wonks often point out that our current banking system most likely has a similar footprint. While that could be true, it misses the broader issue: Bitcoin is not currently replacing the global financial system, nor will it in the next 10 years when we need to be drastically reducing our emissions footprint. In fact, banks are using investments in gold to hedge against the volatility of Bitcoin.

In short, cryptocurrencies are adding to, not replacing the current system. And at a time when we need to decrease global energy consumption to ease the transition to renewables, this addition means we’re doing the opposite: we’re adding more and more demand on top of an already bloated, electricity-consuming world.

A word on crypto-colonialism

After Hurricane Maria, Puerto Rico was reeling. People were swept away by violent storm surges and power went down throughout the country. Puerto Rico was in shock. And, like any good capitalist venture worth its salt, crypto-entrepreneurs moved in quickly. Quite literally, new billionaires rich off of the back of crypto mining, like Brock Pierce, descended on Puerto Rico with visions of transforming the island into a crypto-utopia, buying up post-disaster land for cheap, privatizing public assets, and enjoying the low tax rates of the island.

This is the new crypto-centered version of what Naomi Klein calls the “shock doctrine.” And this digitally-driven capitalist colonialism seems to be spreading across the globe.

📌 In the Democratic Republic of the Congo, for example, foreign bitcoin miners get special access to the cheap, clean energy of the hydroelectric dam in Virunga National Park – a dam originally built to supply electricity needed to help locals find livelihoods beyond poaching, and stop them resorting to scouring parkland for wood fuel.

But the Bitcoin mining operations aren’t supplying jobs, they’re just sapping energy to enrich people halfway across the world.

In a paper on crypto-colonialism, Peter Howson, Senior Lecturer at Northumbria University, argues that “blockchain technology is enabling new forms of resource appropriation from the Global South. These appropriations include land, labor, data and other resources needed to facilitate economic growth elsewhere.” So, while cryptocurrencies are just a technology, they are being used in ways that increase global inequality and exploitation.

The future of cryptocurrency

Most of the problems that cryptocurrencies face are not necessarily due to the nature of digital currency; instead, they seem to be grappling with the harms inherent in making money in a capitalist, imperialist world. One that’s addicted to fossil fuels, and, as a result, subsidizes them no end.

There are some potential solutions to crypto’s outsized energy footprint, however.

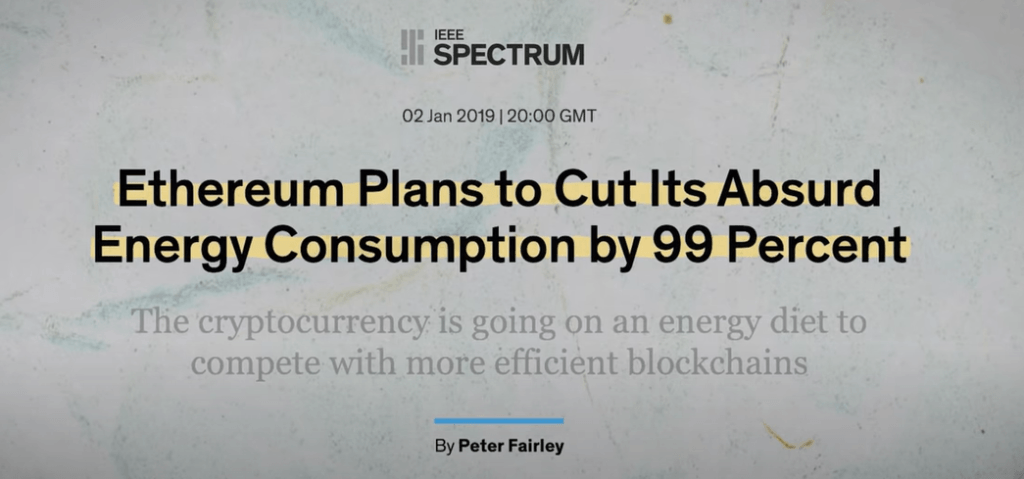

Transitioning from a proof-of-work to a proof-of-stake modeled cryptocurrency could theoretically reduce digital currencies’ energy requirements. This would eliminate the need for mining operations and replace them with a weighted lottery system, of sorts, based on the amount of stake or coins of the validator. It’s a little more complicated than that, but see the links below if you’re interested in learning more. It looks like a promising solution. But at the end of the day, it seems to me that, in their current form, Bitcoin and many other forms of cryptocurrencies are unsustainable, especially in a world that can’t keep itself from guzzling fossil fuels.

👉 At the same time, it’s important to note that cryptocurrencies are relatively new technologies, meaning there are potential avenues to shape them for the better. But for those avenues to succeed, cryptocurrencies need to transition away from a high-energy-consumption model drenched in fossil fuels, and end all exploitative relationships with the majority world. Whether they’ll be able to extract themselves from these harmful paradigms is hard to predict, but it needs to happen if cryptocurrency wants to truly disrupt the world of finance.

Leave a Reply